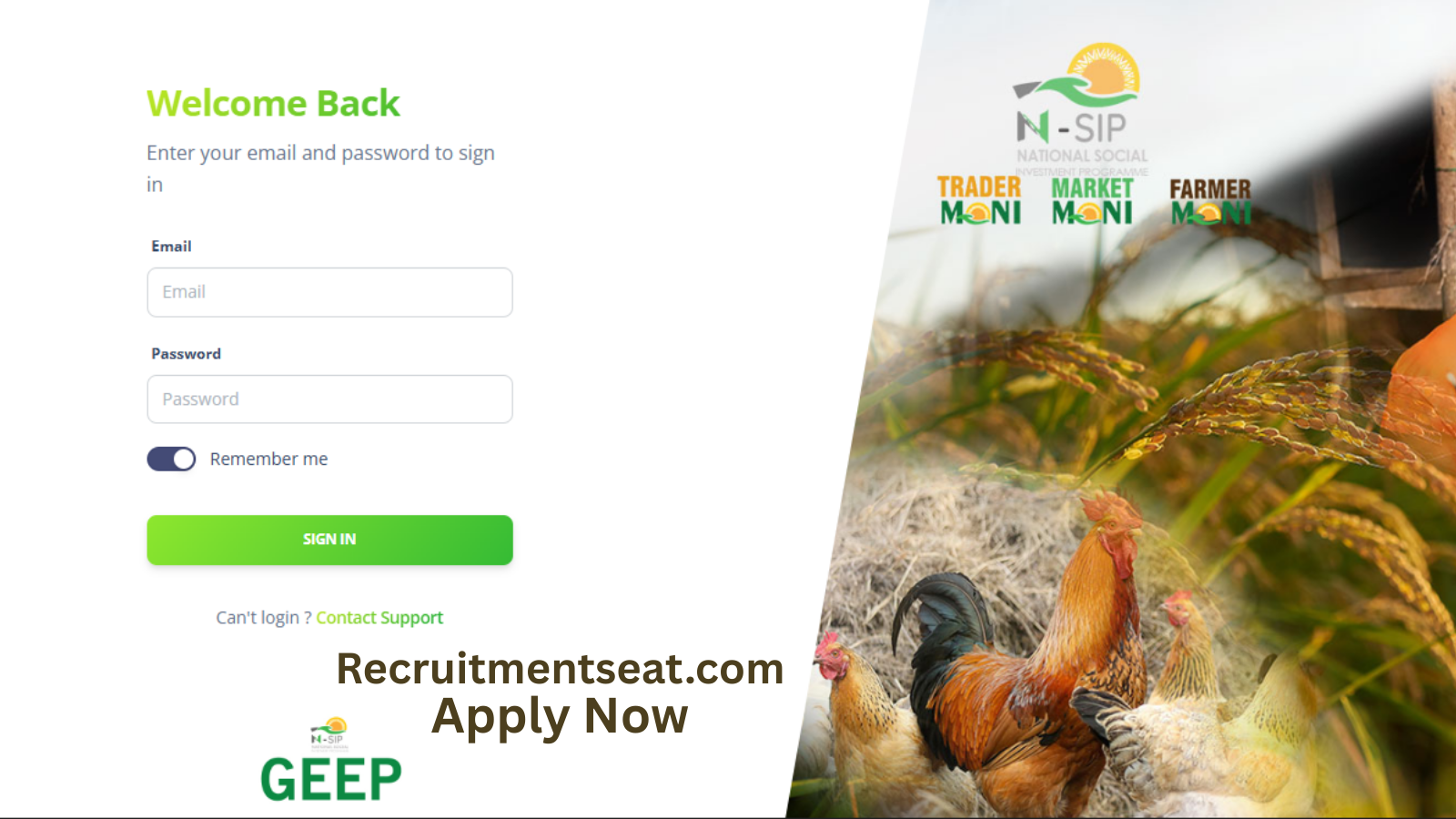

GEEP Loan Application 2025/2026: The Federal Government has reopened the GEEP Loan portal for 2025. This loan supports small traders, farmers, artisans, and youth across Nigeria. The program is part of the National Social Investment Programme (NSIP). It provides interest-free loans to people who run small businesses. This guide explains the GEEP Loan, who can apply, requirements, and the steps.

Overview

The Government Enterprise and Empowerment Programme (GEEP) started in 2016. It targets low-income Nigerians who often lack access to bank loans.

GEEP offers three loan products:

TraderMoni for small traders.

FarmerMoni for farmers.

MarketMoni for artisans and small businesses.

The loans are interest-free.

Borrowers only pay back the exact amount received.

Status

The loan portal is active.

Applications can be submitted online at geep.n-sip.gov.ng. Funds are released in phases across states. Applicants must follow instructions carefully to qualify.

Official Portal

All applications go through the portal:

Avoid fake websites. Do not pay anyone for registration. Application is free of charge.

Eligible Groups

The loan targets:

Small traders in markets.

Farmers in rural and urban areas.

Youth running small ventures.

Women cooperatives.

Artisans like tailors, barbers, mechanics.

Associations and small business groups.

Loan Categories

TraderMoni

For petty traders like food sellers, fruit sellers, and shop owners.

Loan starts from ₦10,000.

Repayment gives access to higher loans up to ₦100,000.

FarmerMoni

For smallholder farmers.

Loan up to ₦300,000.

Targets inputs like seeds, fertilizer, and equipment.

MarketMoni

For small business owners and artisans.

Loan between ₦50,000 and ₦100,000.

Supports business expansion and tools.

Requirements

Applicants must:

- Be Nigerian citizens.

- Be 18 years and above.

- Belong to a recognized trade group, cooperative, or association.

- Have a valid Bank Verification Number (BVN).

- Have a valid phone number.

- Operate a small or micro business.

How to Apply

Follow these steps:

- Visit the Portal Go to geep.n-sip.gov.ng.

- Select Loan Category Choose TraderMoni, FarmerMoni, or MarketMoni.

- Fill the Form Enter your name, BVN, phone number, and business details.

- Join a Group Applicants must belong to a cooperative or group. The group acts as a guarantor for repayment.

- Submit Application Submit and wait for confirmation. You may be contacted for verification.

- Loan Disbursement Approved applicants receive payment into their bank accounts.

Repayment Process

Repay through accredited banks, mobile money agents, or online. Repayment allows access to bigger loans. Default blocks future access to the program.

Benefits

- Interest-free loans.

- Easy access for small traders and farmers.

- No collateral required.

- Nationwide coverage.

- Opportunity to grow small businesses.

Challenges

High demand may delay disbursement.

Verification process may take time.

Repayment discipline required.

Deadline

The GEEP Loan does not have a fixed yearly deadline. Applications remain open in cycles. Applicants should apply early to be considered in each batch.

Key Tips

Apply only on the official portal.

Join a cooperative for easy approval.

Keep BVN and phone number active.

Repay loan on time to qualify for higher amounts.

Avoid agents who ask for payment.

Final Note

The GEEP Loan gives small traders, farmers, and artisans real support.

It is a simple way to expand small businesses in Nigeria.

With interest-free loans, people can grow and repay without stress.

Applicants should act fast and use the official portal only.

Your small business can grow with GEEP Loan.